27+ Irs Abatement Letter Sample

This process gets missed by a lot of tax relief firms and tax attorneys. Take care to confirm the IRS abated the penalty by pulling and reviewing your Account Transcripts.

Sample Power Of Attorney Letter Power Of Attorney Form Power Of Attorney Power

For example if you received an 800000 gift you would be staring down the barrel of a 200000 penalty.

27+ irs abatement letter sample. City State Zip Code. Sample IRS Penalty Abatement Request Letter Homeowners Name Homeowners Address City State Zip Code DATE To the Board of Review or Tax Board or Tribunal. But you may be able to abate the penalty by using form 3520 abatement procedures.

Failure to Timely Contact Taxpayer per IRC 6404 g. They always want the request to be in writing. In response to the unique aspects of the pandemic the AICPA has created a custom penalty abatement letter for members to use as a starting point for relief.

I am sending this letter as notice that I would like to appeal my property tax assessment. First Time Penalty Abatement from IRS With Sample Letter 1. This letter also always contains detailed explanations about the unique situation that led to the non-compliance of the.

For example hospital records or a letter from a doctor with specific start and end dates. A client to whom the IRS grants an FTA will receive Letter 3502C or 3503C 30 for individual failure-to-file and failure-to-pay penalty abatement and Letter 168C or its equivalent 31 for business failure-to-deposit penalty abatement. Request for first-time penalty abatement enter type of penalty and amount if known To Whom It May Concern.

It is easy to be caught off guard if you receive sudden mail email or phone calls telling you the IRS is looking into your taxes but never give out personal information without taking several steps to verify the validity of the claim. The template is available free to AICPA members. Erroneous Refunds per IRC 6404 e 2.

It is several pages long which is atypical of IRS notices and letters. Correction of IRS Error. Just Ask For a First Time Penalty Abatement.

IRS Penalty Abatement Sample Letter Template. City State Zip Re. Congratulations on your efforts to stand up to the IRS.

This penalty abatement request letter is usually written to the IRS to ask the IRS to forgive a tax penalty for a reasonable reason. We respectfully request that the failure-to-filefailure-to-payfailure-to-deposit penalty be abated based on the IRSs First Time Abate administrative waiver procedures as discussed in. Depending on whether the penalty resulted from a gift or trust may impact the ability to qualify for certain exemptions such as Revenue Procedure 2020-17 which is limited to tax deferred retirement and.

Below is a sample letter and breakdown of the components of a competent letter to the IRS about abating your penalties. ENTER DATE To Whom It May Concern. To make or become less.

These records will prove that you were indeed incapacitated or too ill. Many people do not know it but the. 27 Dec 2016 in Tax Guide tagged forms IRS tax debt tax resolution by Robert Kayvon Esq.

A letter written to the IRS for this effect of waiving a tax penalty levied against the taxpayer therefore is what we call a penalty abatement request letter. Request for Penalty Abatement. Usually the letter arrives about four weeks after the IRS grants the first-time abatement.

If the IRS approves the first-time abatement request you will receive either Letter 3502C 3503C or 168C or its equivalent in the mail. But it is merely to get the IRS agent to place a 60 day hold on any IRS lien proceedings. Waive Penalty Fee Sample Letter Waiver Of Penalty The.

The details as to why my home is over assessed are given below. Inform client of the following points. You should always address this correspondence to the Internal Revenue Service and send it to the address listed on the written notice of the tax due.

Facts in your IRS penalty abatement letter to back up the circumstances that you write about in your letter. Little can be done once scammers have your information or money so take extra precaution as you will. Abatement of a penalty.

Sample Letter January 1 2012 Internal Revenue Service. As part of this tax waiver process you are going to call the IRS. The IRS will not waive the penalty on the phone.

The template is available free to AICPA members. IRS continually tries to recover outstanding tax debt it may agree to cut down or waive tax penalties and interest if a taxpayer is able to provide a satisfactory reason for their non-compliance. Suspends the interest if the IRS does not timely 36 or 18 months notify the taxpayer of a proposed liability.

Updated 123 days ago Get Free Money Back. The letter usually arrives about four weeks after the IRS. The reason why I failed to report income was because I was suffering from a serious medical condition.

IRS Form 990 Late Filing and Failure to File Form 990 Penalty Abatement Abatement n. I am writing this letter to request an abatement of penalties in the amount of 567850 as assessed in the notice enclosed with the letter that is dated 18 th November 2014. Allows an abatement of interest on the repayment of an erroneous refund of 50000 or less.

Request for Penalty Abatement under Reasonable Cause. I was hospitalized for the same due to which I could not report my income. The AICPA has a template for practitioners to use to request a reasonable-cause penalty abatement on behalf of their clients.

Here we go through the IRS First Time Penalty Abatement process.

How To Request A Payment Plan Letter

Palmstrom Rmi Pdf Pdf Strength Of Materials Geology

Form 1 Nr Py Instructions Mass Gov

Get 21 Raft How To Get Egg Kettha

Get 21 Raft How To Get Egg Kettha

Get 21 Raft How To Get Egg Kettha

Http Seatnow Org Wp Content Uploads 2021 05 Comments By State Pdf

Get 21 Raft How To Get Egg Kettha

Get 21 Raft How To Get Egg Kettha

Get 21 Raft How To Get Egg Kettha

Get 21 Raft How To Get Egg Kettha

Http Seatnow Org Wp Content Uploads 2021 05 Comments By State Pdf

Palmstrom Rmi Pdf Pdf Strength Of Materials Geology

General Specifications For Road And Bridge Construction

Writing A Irs Penalty Abatement Request Letter With Sample Lettering Writing Resignation Letters

Irs Response Letter Template Samples Letter Template Collection Regarding Irs Response Letter Template 10 Letter Templates Cover Template Collection Letter

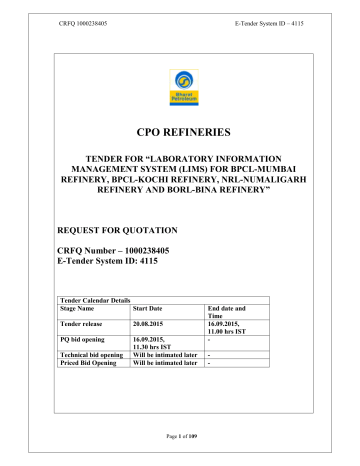

Cpo Refineries Bharat Petroleum Manualzz

Get 21 Raft How To Get Egg Kettha

General Specifications For Road And Bridge Construction

Irs Audit Letter Cp75a 2017 2018 Lettering Irs Letter Templates