24+ Tax Exempt Letter Sample

Only certain individuals organizations and institutions will quality for a tax exempt certificate. To otherwise receive a copy of the original determination letter submit a request using Form 4506-A or in a letter containing the name and employer identification number of the organization along with the name address and phone number of the requester.

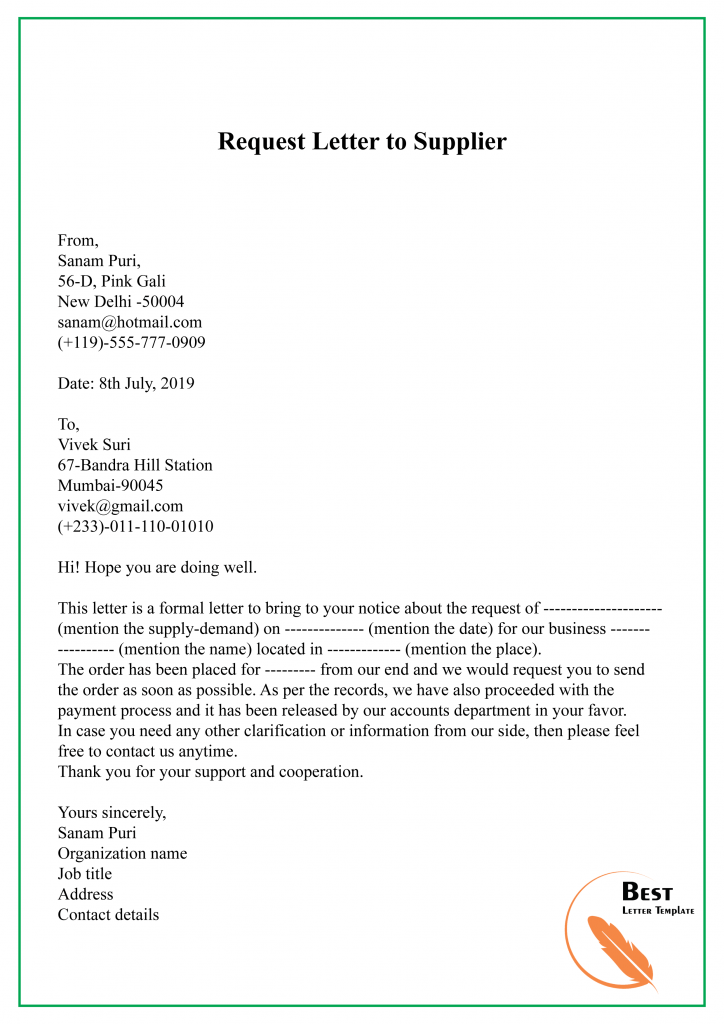

View 40 Sample Letter To Supplier Requesting Statement Of Account

In some cases you must also have a valid Certificate of Authority to use an exemption certificate see the chart at the end of this bulletin.

24+ tax exempt letter sample. Either a amount donated if cash or cash equivalents. It summarizes the law regarding the tax-exempt status of state and local governments under Internal Revenue Code section 170c1. Select a taxpayer from the list.

The IRS sends notices and letters for the following reasons. Exempt Organizations Form 1023-EZ Approvals. A tax exempt certificate is a document used by the Internal Revenue Service to grant a tax exempt status to certain non-profit or charitable organizations.

A group exemption letter is a ruling or determination that is issued to a central or parent organization generally a state regional or national organization which holds that one or more subordinate organizations usually a post unit chapter or local are exempt from federal income tax. Sample TAX EXEMPTION ENTITY 123 SAMPLE ADDRESS ANYWHEREFL 000000 is exempt from the payment of Florida sales and use tax on real property rented transient rental property ranted tangible personal property purchased or rented or services purchased. Other Nonprofit or Tax-Exempt Organizations 501a Form 1024 PDF.

Select Request CertificateClearance Letter under the Franchise Tax eSystems menu. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501c3. A GEL pertains to organizations that have been recognized by the IRS as tax exempt organizations.

Name of employee. You intend to use the property or service for a purpose that is exempt from sales tax. To verify your identity.

If the taxpayer for whom you are requesting a certificateletter is not listed add the taxpayer to your assigned account list using their 11-digit taxpayer number and Webfile XT number. UCB work address. FLORIDA Important Information for Exempt Organizations DA-14 R1015 1.

Or b description of the property donated the nonprofit should not attempt to assign the cash. If so an organization may generally contact Customer Account Services by phone letter or fax to request an affirmation letter. If you are an Indian and receive your share of your former spouses or common-law partners pension benefits as a result of the breakdown of your marriage or common-law partnership and it relates to your former spouses or common-law partners employment income that was wholly or partially exempt from income tax under section 87 of the Indian Act the amounts you receive will also be wholly or partially exempt from income tax.

Never trust a letter just because it says IRS. FAQs - Applying for tax exemption. A letter or fax requesting an affirmation letter must include your organizations.

Note that many exemption certificates are very specific about. IRS exempt Determination Letter Stamped South Carolina Articles of Incorporation and bylaws B11a - Nonprofit housing corporations Devoted exclusively to providing below-cost housing for aged or handicapped persons as authorized by Section 202 of the Housing Act of 1959 and regulated in part by 24 CFR Part 885. You make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

And it explains the conditions that must be met for governmental organizations to qualify for federal income tax. Publication 4220 Applying for 501c3 Status PDF. Beware of Fake IRS Letters.

A notification of processing delay. You can send your request by fax to 855-204-6184. 1 FLSA conversion letter for those moving to Non-Exempt status.

A request for expedited processing must be made in writing and must fully explain the compelling reason. Publication 557 Tax-Exempt Status for Your Organization PDF. The certificate must be presented to the organization or institution in order for them to be recognized as tax exempt.

13020XX Date of letter to donor Dear John and Joan Thank you for your charitable gift in the amount of XXXXXX from your Individual Retirement Account IRA on January 24 20XX in support of our mission to provide advisory and training services that help charitable organizations be more effective. A summary of the tax advantages accorded to charities 1 Inland Revenue Ordinance a Section 88 provides that charitable institutions or trusts of a public character are exempt from tax under the Inland Revenue Ordinance. 1 FLSA conversion letter for those moving to Non-Exempt status 2 FLSA conversion letter for those moving to Exempt status.

A tax exempt organization may need a letter to confirm its tax-exempt status or to reflect a change in its name or address. The letter provides the reader general information under IRC section 1151 regarding the federal income tax status of an entity that performs essential government services. Many organizations in the United States maintain a GEL and obtaining one can be of benefit to an organization.

FAQs - Form 1023. Instructions for Form 1024 PDF. Additional information is required.

B Proviso to section 88 states that for the purpose of Profits Tax if a charitable. Granting expedited processing is at the discretion of the IRS. An organization may not request expedited handling of a Form 1023-EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code.

Questions regarding your tax return. As a result of a recent review of the positions you hold it has been determined that. A Group Exemption Letter or GEL is a special letter that is issued by the United States Internal Revenue Service IRS.

A change in your refund amount.

Event Sponsorship Proposal Pdf Unique Free 47 Sponsorship Proposal Examples Samples Pdf Word Pages Google Doc Sponsorship Letter Letter Sample Letter Example

Pin On Biodata Format Download

Gpf Missing Credits Blank Proforma Business Credits Read Online For Free Blanks

View 40 Sample Letter To Supplier Requesting Statement Of Account

Just Downloaded A Useful Free Complaint Letter Template From Vertex42 Com Letter Templates Letter Templates Free Cover Letter Template Free

Free 50 Appreciation Letter Samples In Pdf Ms Word Pages Google Docs

View 40 Sample Letter To Supplier Requesting Statement Of Account

View 40 Sample Letter To Supplier Requesting Statement Of Account

A Beginner S Guide To Vertical Analysis In 2021 Income Statement Statement Template Financial Analysis

Congratulation Letter Template 9 Free Sample Example Format Download Free Premium Templates

Gpf Missing Credits Blank Proforma Business Credits Read Online For Free Blanks

Leave Letter Formats 24 Free Printable Word Pdf Text Lettering Letter Templates Free Marriage Rights

View 40 Sample Letter To Supplier Requesting Statement Of Account

24 Sample Letter Informing Meeting Date

Beautiful Official Invitation Letter Samples Collection Letter Template Word Invitation Letter Formal Invitation Letter

Personal Letter Of Recommendation For Youth Volunteer Reference Letter Personal Reference Letter Reference Letter Template

View 40 Sample Letter To Supplier Requesting Statement Of Account

Free 50 Appreciation Letter Samples In Pdf Ms Word Pages Google Docs

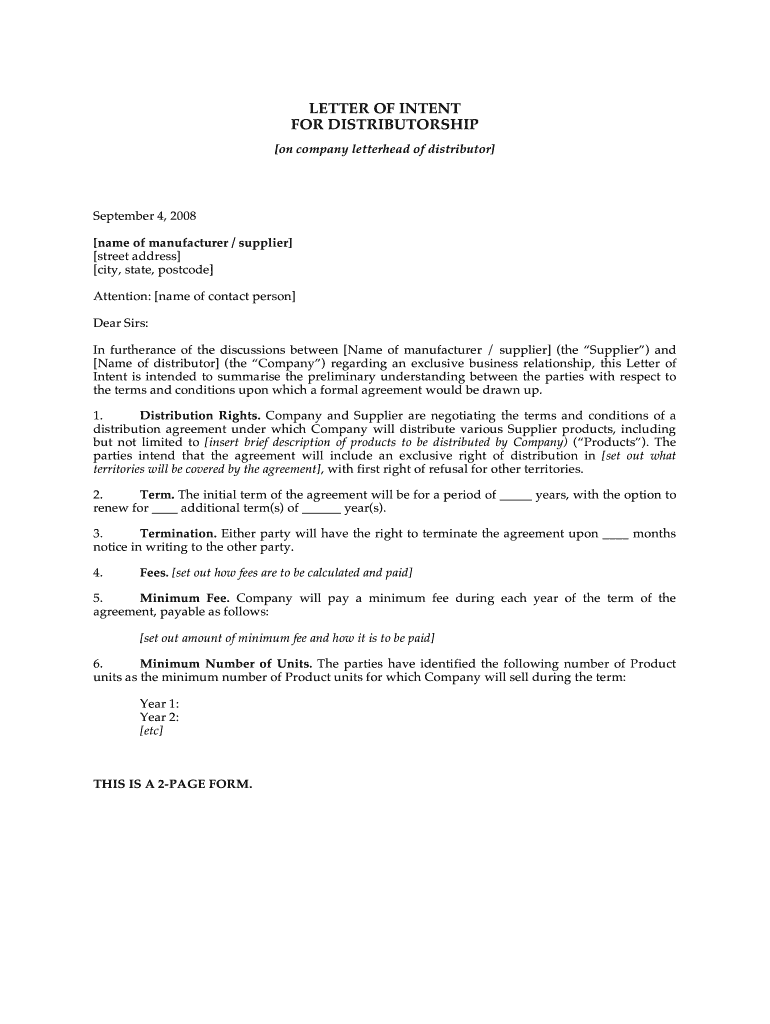

Request Letter Format With 24 Sample Letters Doc Formats

Congratulation Letter Template 9 Free Sample Example Format Download Free Premium Templates